EMERGING SOURCES OF CLIENTS, SUPPLY VERSUS DEMAND IMBALANCES AND MUCH MORE

The growing popularity of Portugal

Some would say that it is ironic that the international market and investment has done what Portugal and the Portuguese could not find the courage to do themselves, namely value their patrimony fairly. With decades of cheap real estate culminating in the financial crash of 2008-2009, the Portuguese were extremely hesitant in making investments in the real estate market of their own country. Accustomed to seeing the dramatic effects of global crises reflected in extremely difficult local market conditions, the majority of the population remained sceptical when the first signs of a recovery when noted around 2014. As international investment grew, bolstered by programmes such as the Golden visa and the non-habitual resident programme, real estate prices rapidly increased, and by the time most Portuguese had gathered enough courage to act, most had been priced out of the market.

The effect of Portugal’s popularity on real estate prices

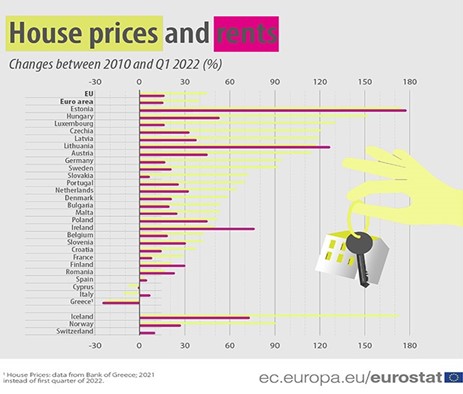

According to a report compiled by Idealista, Portugal prices have increased 70% in 10 years (2012-22), much higher than the European average of 45%.

The source of growth

As an example, Savills’ World Cities Prime Residential Index, which includes 30 cities around the world, ranked Lisbon as the 7th city where prices had grown the fastest in the first half of 2022, at 3.7%, versus an index average of 2.4%.

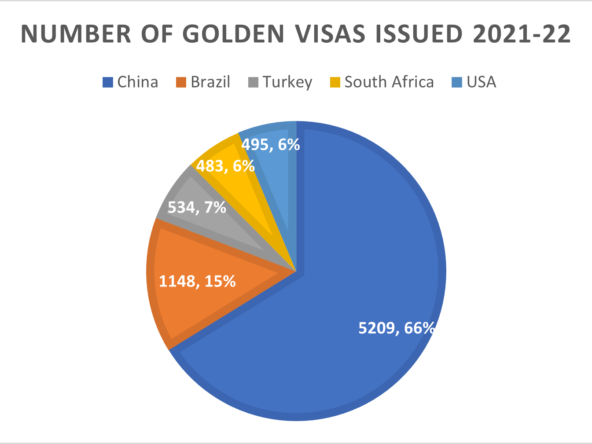

The role of foreign direct investment (FDI) on Portugal’s real estate market

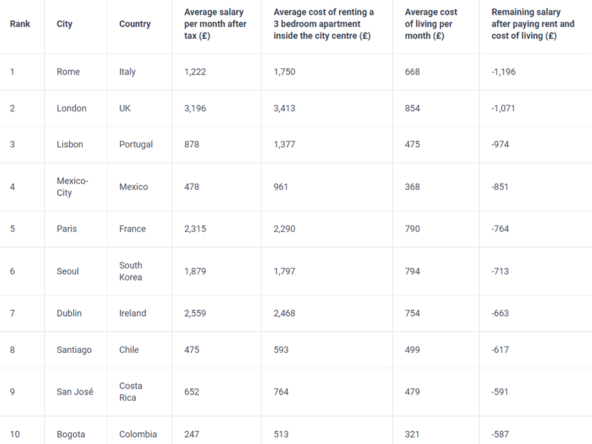

Although the cyclical nature of real estate markets (and indeed economies) is acknowledged, this decade-plus cycle of sustained growth in Portugal, largely independently of a pandemic, a war and of somewhat depressed internal demand, seems to indicate something different. Given that Portugal’s internal market is largely unable to sustain such growth, due to still-low salary levels (and consequently limited disposable income) and small size, it is the international market and foreign investment that has been the main driver of this trend.

Backing up this opinion is a quote in Essential Business in July 2022 that confirms that “in 2012, as Portugal was still in the depths of the Great Recession, 46% of investment in Portugal came from overseas, today that figure has shot up to 85%…the overall investment in real estate development in Portugal, in 2016, was €200 million of which less than 50% came from overseas investors. That figure has shot up to an incredible €375 million in 2021, a year in which the world was still affected by the pandemic.”

The National Institute of statistics reports that investment from EU countries increased by 72.3% in Q1 2022, while foreigners buying from non-EU countries increased by 79.1%. In total, foreigners acquired 2556 properties in the first quarter of 2022.

At a granular level, what we observe is the increase in wealthier investors and buyers, meaning that competition for product is greater, prices tend to increase and demand for the upper and luxury segments of the market including new build, remains fairly buoyant.

One of the reasons for this is the trend described in the Henley global citizens report 2022 which shows that Portugal ranks in the top 10 countries expected to receive new millionaires during this year, approximately 1300. New World Wealth shows that Portugal 4, for example, has been one of the most popular destinations for the flow of HNW capital, capturing some of the 4500 high net worth South Africans that have left the country in the last decade.

Bloomberg UK also quotes a Savills report stating that Lisbon, together with Miami and Dubai, is ranked as the top city for high earning remote based talent, specifically senior staff.