THE END OF THE PORTUGUESE GOLDEN VISA?

At the 2023 Web Summit, Portugal’s Prime Minister threw the cat among the pigeons stating that it was time to re-evaluate the Golden Visa program, and that it probably did not justify retaining the program. Real estate agencies and associations were up in arms, arguing that the program had not played a role in distorting the market and that it would cut off an essential source of foreign direct investment to the country.

How important is the Golden Visa program?

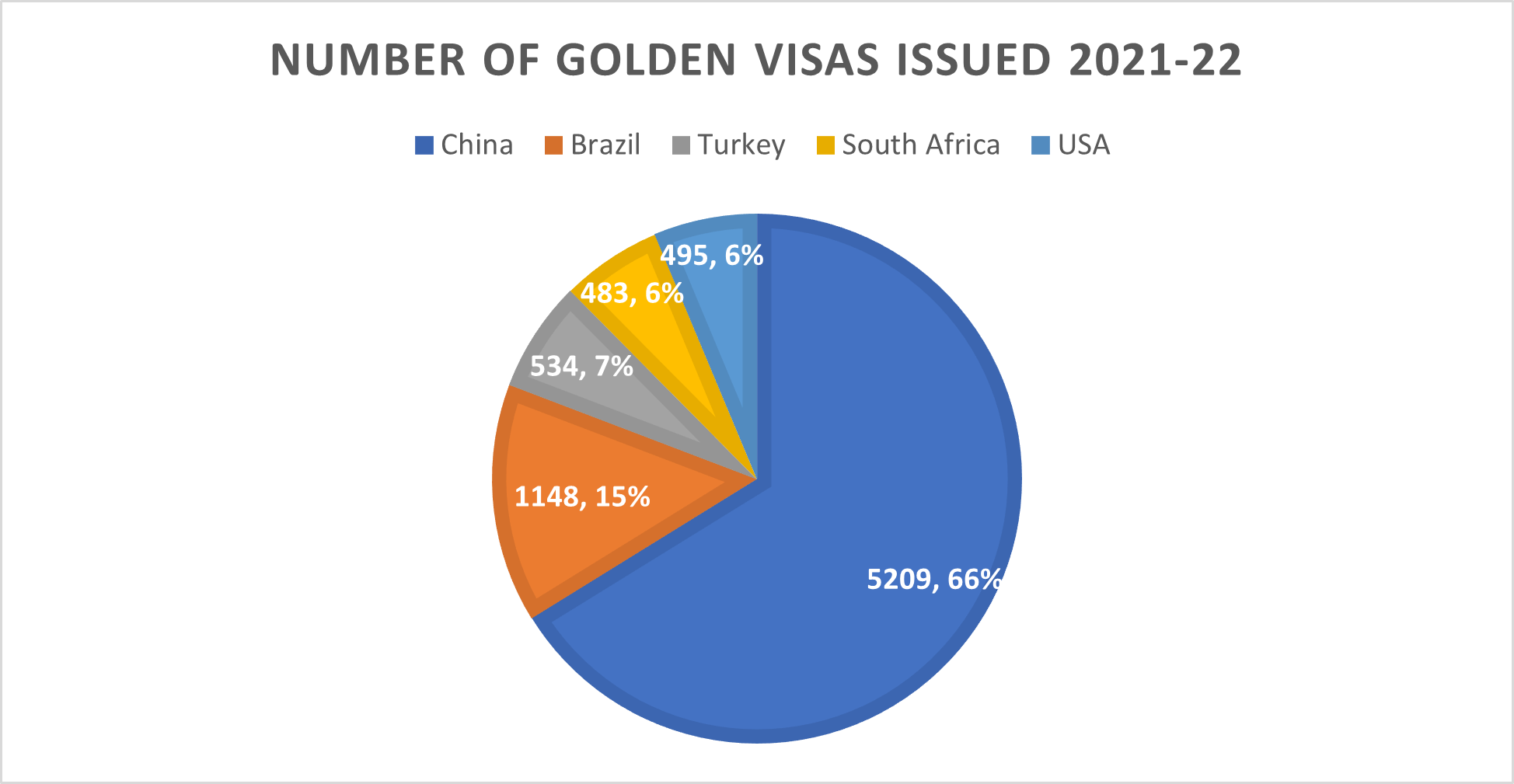

As can be seen from the above graphic (data source: SEF), the Golden Visa program has seen almost 8900 visas issued, contributing more than €6 billion to the Portuguese economy. Those who argue in favor of retaining the program cite the regeneration of abandoned urban areas as one of the program’s most positive legacies. There is no doubt that the centers of Lisbon and Porto have benefited tremendously in this regard, and have now become global visitor favorites.

Why is the Golden Visa program controversial?

As can be seen below, despite the positive impact on the redevelopment and gentrification of inner urban neighborhoods, the number of urban regeneration visas represents only 12.5% of the total investment, meaning that the remainder is primarily made-up of second homes, which are rarely used or visited by their owners, and have therefore gone primarily into the short-term rental market. The program’s critics point to the Golden Visa as being the main contributing factor to the dramatic inflation in prices of local real estate, and the increasingly difficult access by local residents to affordable housing.

In defense of the Golden Visa program, Portugal’s laws currently very much favor short-term rentals:

- Short-term or local lodging attracts a substantively lower tax than properties rented out on a long-term basis;

- The rental law for long-term tenants is weighted very much in favor of the tenant, much more so than short-term lodging;

- The government talks about encouraging investment into the build to rent sector, but there is no real sign of meaningful intent in this regard, for example with VAT on construction remaining extremely high at 23%;

- Recent action by the government to cap rents in what is effectively government intervention in a private sector activity, where owners already pay substantial taxes on property, does not bode well for a sector which has historically been seen as an “easy target” for government tax.

No one, regardless of whether generally in favor or against the Golden Visa program, denies that it has had a substantial inflationary effect on prices, in particular within urban areas such as Lisbon and Porto. A significant part of this increase occurred at the start of the program, when average two-bedroom apartment prices in Lisbon were around €250,000, and these immediately went up to almost double in order to ensure adherence to the Golden Visa threshold. Admittedly in the early days, it was mainly new build inventory, much of it located in the Parque ds Nações (also known as the Expo) area, that attracted investor attention, but gradually the scope creep extended to all new build inventory in the Lisbon area, and finally, due to lack of product, that trend extended to all two-bedroom inventory, whether new or resale, in the city.

The debate about access to affordable housing for local residents is not unique to Portugal, with several other countries such as Australia, Spain, the Netherlands and others debating the merits versus disadvantages of Airbnb style accommodation, and what limitations should be placed on the sector. Portugal followed this lead by imposing bands on the issuing of additional short term rental licenses in historical neighborhoods of Lisbon and Porto.

The majority of investment that has accrued from the Golden Visa has not gone to the local economy. The lion’s share of the €6 billion has been divided up between developers, landowners, and the government. Professional firms such as lawyers have been some of the most benefited during the cycle, with average Golden Visa processing fees ranging from €5000 to €25,000 per applicant. Therefore, while there has been unquestionable advantage in terms of regeneration and kickstarting the process of making the centers of Portugal’s most important cities more appealing, legacy that has been left and which has made those centers among the most popular in the world, it is an exaggeration to state that the Golden Visa program has benefited the general local economy.

What is the alternative to the Golden Visa?

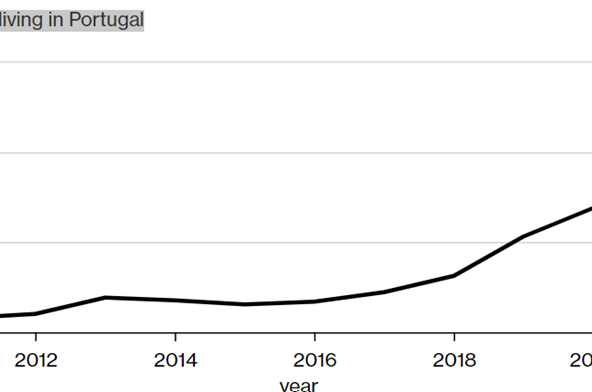

We have been arguing for a long time that what Portugal needed to do was to attract more permanent residents who would contributes directly to the local economy by spending on local services, and paying their tax locally by virtue of spending more than 183 days in the country (and therefore becoming tax residents).

For many years, Portugal has had an alternative residency visa, commonly known as the D7, which had been looked down upon by the real estate industry, lawyers, and other consultants, as the “poor sibling” of the Golden Visa. The reason for this is that the D7 application can be perfectly handled, admittedly with some patience, by the applicant themselves. It also permits applicants to use a rental, as an alternative to a property purchase, to apply. The combination of the two points above meant that the real estate sector and the support services associated with it, did not regard this residency application as a potential revenue stream.

Today, with the number of changes to the Golden Visa program, many of those professionals have now turned their hand to advising on the D7 application, with independent consultants and advisors charging anywhere between €1000 and €15,000 per applicant, for a process that can be done for a few hundred Euros by the applicant themselves. On the other hand, it has also sparked the proliferation of self-help groups, many of which on social media, and the amount of misinformation has grown.

Nonetheless, the industry as a whole will find it difficult to wean itself off the Golden Visa revenues, which are relatively easy to earn.

Will the Golden Visa program change and what changes might be implemented?

Any change, given that no formal announcement has been made, is at this stage purely speculative, but it is not unreasonable to use past experience to extrapolate what might happen. We do not believe that the government is serious about implementing the very necessary structural change, such as to taxation, in order to improve the residential accommodation market. Nonetheless, it seems clear that the days of the Golden Visa program in its original state are numbered, as we have seen from changes in January of 2022, and the statements now being made.

Historically when a senior political figure makes an announcement or a prediction of this type, we anticipate that change will be inevitable. It does not mean that the changes will be implemented exactly in the manner of the original announcement, but it is an early warning system to the fact that changes will happen. Much of the change to the Golden Visa program has been a political exercise, in terms of the ruling Socialist Party offering something to the left-wing parties in parliament, to keep them onside and supportive all of the government’s broad program and agenda. The Golden Visa program is therefore one among many negotiating points between the government and parties to the left, who ideally would like to see the program ended completely, because they argue that it has contributed substantially to social and economic inequality in the country.

The Portuguese government is also releasing new visas, such as the digital nomad visa, and the preferential visa for applicants from Portuguese speaking countries, and many of these visas point to different accommodation requirements, either of a shorter residential nature, or a permanent rental, rather than a purchase.

Buyer beware! The need for caution in a changing landscape

We believe that a complete cancellation of the program would have a potentially disastrous effect on any Golden Visa investment that has been made in inland areas, or the islands of Madeira and the Azores, as that demand will be totally removed from the market, meaning that resale of those properties, most of which will have been purchased at a premium to meet Golden Visa thresholds, will be much more difficult without the seller incurring a loss.

As a result, investors are urged to exercise caution in relation to any investment in non-coastal low-density regions of continental Portugal, or the islands, under the Golden Visa program. Any changes to the program are likely to affect these regions much more dramatically than the more popular coastal regions, where demand has been historically strong.

Although much more protected than real estate further inland, caution is also necessary in relation to coastal Golden Visa product, especially of a touristic nature, and which tends to come with high condominium or HOA fees. We encourage investors to consider well priced opportunities, as and when they occur, or better still to focus on investment into the much more flexible Golden Visa compliant residential product in coastal areas, that operates in line with supply and demand in the market. This type of product will be less prone to the effect of any Golden Visa program changes, as well as less exposed to high management costs associated with resorts.

An opportunity for a positive contribution to the residential rental market

We are of the view that the program could be altered to help drive much needed residential accommodation supply in the market. Similarly to the restrictions on local lodging that have been implemented in the historical regions of Lisbon and Porto, a restriction on short term licensing for Golden Visa properties, for a period of five years, could be a way of forcing the product onto the longer term accommodation market, thus contributing to the alleviation of supply problems.

As we have argued consistently, this should be accompanied by a reduction of tax, to ensure that long term rental accommodation pays tax on the same basis and using the same rules as short-term accommodation.